|

Discover the first-in-the-industry, AI-powered digital assistant for insurance agents. Ask Integrity AI is integrated into MedicareCENTER and will change the way you do business.

|

Carrier Resources

|

aetna

Contracting transfer blackout dates: 10/1 - 12/31 unitedhealthcare

Contracting transfer blackout dates: 9/1 - 12/31 |

cigna

Contracting transfer blackout dates: 9/1 - 12/31 silverscript

wellcare

Contracting transfer blackout dates: 10/1 - 12/8 |

Training Events

Training Events

AHIP Training |

|

What you'll learn & FAQs

|

The standard cost of AHIP certification is $175, but most carriers will offer a $50 discount making your cost $125. You have 3 attempts to get a passing score of 90% for the final exam. Some carriers will even allow you to pay another $175 and take the test 3 more times. Your certification lasts 12 months and you must re-certify each year. You can download slides from each module for review and take practice quizzes. The actual exam is open book, so you can rely on your notes and practice quizzes to help you. The final exam is made up of many questions from the review quizzes which is helpful. You have 2 hours to complete the final exam, but the training modules are not timed, allowing you to pace yourself. Most agents complete the final exam in less than 2 hours and it contains 50 questions. Most carriers require AHIP certification before you can take their training to sell their Medicare Advantage or Prescription Drug plans. There are a few exceptions, but it is definitely recommended that you complete AHIP Certification if you plan on selling Medicare Advantage or PDP plans. You can transmit your scores directly from your AHIP account. You can also log into the carrier site where you would like your score transmitted and use their internal links to connect to AHIP’s website to transmit your score. Once you’ve completed your certification and exam, you will receive a link to a printable copy of your certificate. |

Access training for both Medicare and Fraud and Waste and Abuse (FWA). AHIP's online program gives you the background to make informed decisions on Medicare, including plan options, marketing, enrollment requirements, and FWA guidelines. If you only sell Medicare Supplement products, you do not need to complete AHIP training.

Maximum MAPD & PDP Commission Rates

Product |

Region |

2023 Initial |

2024 Initial |

%↑ |

2023 Renewal |

2024 Renewal |

%↑ |

MAPD |

National |

$601 |

$611 |

1.66% |

$301 |

$306 |

1.66% |

MAPD |

CT, DC, PA |

$678 |

$689 |

1.62% |

$339 |

$345 |

1.77% |

MAPD |

CA, NJ |

$750 |

$762 |

1.6% |

$375 |

$381 |

1.6% |

MAPD |

PR, USVI |

$411 |

$418 |

1.7% |

$206 |

$209 |

1.46% |

PDP |

National |

$92 |

$100 |

8.7% |

$46 |

$50 |

8.7% |

Note: insurance carriers are not required to pay the maximum commission rate.

Checklist Review

|

Finish any contracting you may have started, complete it and review any carriers you wish to add. Carriers have blackout dates where you can no longer move your contract.

Be sure to complete your AHIP training. Many carriers offer discounts, but you must access the training through the carriers' agent websites to receive that discount.

Complete all product training. You'll get notified by the carrier when you’re eligible to being selling. Watch your Inbox carefully for important emails.

|

If you're not offering Prescription Drug Plans be sure to download our Part D Plan finder guide.

Begin marketing yourself early, and be sure to request our complimentary, marketing materials.

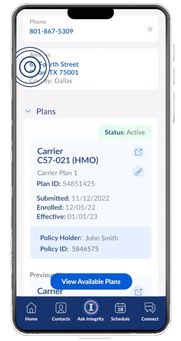

Login to MedicareCENTER and get familiar with all the new tools available. Download the mobile app.

|

Contact Rules

Agents must receive proper permission to contact before calling or meeting with prospective or potential Medicare Advantage or PDP clients. Agents are allowed to make unsolicited telephonic contact to

their current clients in the following scenarios:

Agents may use the following methods to make unsolicited direct contact with potential MA or PDP clients, provided they meet all federal, state, carrier, and MCMG guidelines

Agents may not use the following methods in order to contact potential MA or PDP clients

Agents who have a pre-scheduled appointment with a potential enrollee who is a “no-show” may leave information at that potential enrollee’s residence.

their current clients in the following scenarios:

- At any time about their client’s current plan

- At any time to discuss plan business if the client has not opted out of such contact

Agents may use the following methods to make unsolicited direct contact with potential MA or PDP clients, provided they meet all federal, state, carrier, and MCMG guidelines

- Conventional mail and other print media (ex. Direct mail, ads, banners, websites, etc.)

- Email, provided all emails contain an opt-out method and a process is in place to ensure further emails are not sent to those who opt-out

Agents may not use the following methods in order to contact potential MA or PDP clients

- Door-to-door solicitation, which includes:

- Leaving information (i.e. leaflets, flyers, etc.) at a residence

- Going to a residence without a previously schedule appointment for that date and time

- Going to a residence on the basis of a returned Business Reply Card (BRC) or other

- documentation whereby a potential client requested additional information and provided their address

- Approach potential clients in common/public areas (i.e. parking lots, hallways, lobbies, sidewalks, etc.)

- Telephonic solicitation (i.e. cold-calling), texts, or electronic voicemails

- Other prohibited telephonic activities include:

- Unsolicited call about other lines of business to generate Medicare leads (considered bait and switch)

- Calls based on referrals (i.e. referrals from current clients are not considered permission to contact)

- Calls to market products to former clients who have disenrolled

- Calls to potential clients who attended a sales event, unless the client gave express permission at the event for a follow-up call (there must be documentation of permission to be contacted)

- Calls to prospective enrollees to confirm receipt of mailed information

Agents who have a pre-scheduled appointment with a potential enrollee who is a “no-show” may leave information at that potential enrollee’s residence.

Call Recording Requirements

|

All TPMOs, which include licensed sales agents, must record all sales, marketing, and enrollment calls with Medicare beneficiaries in their entirety, including the enrollment process and pre- and post-sales calls. This requirement pertains to telephonic, virtual, and online

conversations. Only the audio of the calls using web-based technology must be recorded. Recordings must be stored in accordance with CMS storage requirements for a duration of no less than 10 years. Please note, face to face (in-person) appointments are not required to be recorded and are exempt from this guidance. Our organization does not dictate the technology to be used for these recordings. However, we do have software solutions available through our MedicareCENTER system that allow users to record and store calls with beneficiaries. |

Agents must notify beneficiaries that the call is being recorded at the start of the call and must capture consent to proceed. Should a beneficiary decline to have their call recorded, the agent should attempt to schedule an in-person meeting with the beneficiary.

Call recordings should be readily available and reproducible within 24 hrs should a Carrier, CMS, or an upline entity request them.

Call recordings should be readily available and reproducible within 24 hrs should a Carrier, CMS, or an upline entity request them.

Marketing Rules |

In April 2023 CMS updated the following rules for marketing and communications with regard to offering Medicare Advantage and Prescription Drug Plans for 2024. When marketing these plans the following language must include one of the messages below. The message must be:

- Verbally conveyed within the first minute of a sales call.

- Electronically conveyed when communicating with a beneficiary through email (email signatures), online chat, or other electronic means of communication.

- Prominently displayed on agent/agency websites and in email signatures.

- Included in any marketing materials, print materials and advertising.

If a TPMO does not sell for ALL plans in the service area, the disclaimer reads as follows:

“We do not offer every plan available in your area. Currently we represent [insert number organizations] organizations which offer [insert number of plans] products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program to get information on all of your options.”

If a TPMO sells for ALL plans in the service area, the disclaimer reads as follows:

“Currently we represent [insert number of organizations] organizations which offer

[insert number of plans] products in your area. You can always contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program for help with plan choices.”

The disclaimer is not required for TPMOs that sell plans on behalf of only one Medicare Advantage carrier or PDP carrier.

“We do not offer every plan available in your area. Currently we represent [insert number organizations] organizations which offer [insert number of plans] products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program to get information on all of your options.”

If a TPMO sells for ALL plans in the service area, the disclaimer reads as follows:

“Currently we represent [insert number of organizations] organizations which offer

[insert number of plans] products in your area. You can always contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program for help with plan choices.”

The disclaimer is not required for TPMOs that sell plans on behalf of only one Medicare Advantage carrier or PDP carrier.

Agents and brokers may no longer make available or collect SOAs at educational events. Agents and brokers may no longer set up personal marketing appointments at educational events. Agents and brokers MAY make available and receive beneficiary contact information, including Business Reply Cards.

Scopes of Appointment are valid for 12 months following a beneficiary’s signature date. Business Reply Cards or requests to receive additional information are valid from the beneficiary’s signature date or the date of the beneficiary’s initial request for information. CMs explains that using a 12 month limit will facilitate a beneficiary giving permission annually to be reminded about the next AEP and the opportunity to evaluate (or re-evaluate) Medicare Advantage and Part D plan options.

CMS prohibits the use of the Medicare name, CMS logo, or products or information issued by the Federal Government, including the Medicare card, in a misleading manner. Use of the Medicare card image is only permitted with authorization from CMS.

The MA plan or PDP sponsor (or agent or broker) must agree upon and record the Scope of Appointment with the beneficiary 48 hours prior to the scheduled personal marketing appointment or meeting, except for:

Scopes of Appointment are valid for 12 months following a beneficiary’s signature date. Business Reply Cards or requests to receive additional information are valid from the beneficiary’s signature date or the date of the beneficiary’s initial request for information. CMs explains that using a 12 month limit will facilitate a beneficiary giving permission annually to be reminded about the next AEP and the opportunity to evaluate (or re-evaluate) Medicare Advantage and Part D plan options.

CMS prohibits the use of the Medicare name, CMS logo, or products or information issued by the Federal Government, including the Medicare card, in a misleading manner. Use of the Medicare card image is only permitted with authorization from CMS.

The MA plan or PDP sponsor (or agent or broker) must agree upon and record the Scope of Appointment with the beneficiary 48 hours prior to the scheduled personal marketing appointment or meeting, except for:

- (i) SOAs that are completed during the last 4 days of a valid election period for the beneficiary; and

- (ii) unscheduled in person meetings (walk-ins) initiated by the beneficiary.

What can your clients do during AEP?

|

1. Change from Original Medicare to a Medicare Advantage plan (or vice versa)

2. Switch from one Medicare Advantage plan to another Medicare Advantage plan 3. Switch from a Medicare Advantage plan that doesn't have drug coverage to one that does offer drug coverage (or vice versa) |

4. Join a Medicare Prescription Drug Plan (PDP)

5. Switch from one Prescription Drug Plan (PDP) to another PDP 6. Drop Medicare Prescription Drug coverage completely |

Medicare Supplement Applications

Type of application - AEP doesn’t mean the application is automatically Open Enrollment or Guaranteed Issue.

Open enrollment applies only to persons who are first enrolling in Medicare Part B or turning age 65.

Guaranteed Issue applies only to Medicare beneficiaries who are losing (or disenrolling) in their current health care coverage under a qualifying Guaranteed Issue provision and these applications must include proof of credible coverage which supports the qualifying Guaranteed Issue event. (Guaranteed Issue provisions vary by state; if in doubt, call underwriting before taking a Guaranteed Issue application. And, don’t forget to attach the proof of credible coverage to the application.)

Underwritten applies to all other applications, where the applicant must answer all of the health questions.

Proof of credible coverage is required for all Guaranteed Issue applications and must be attached to the application (including an e-App). The document must be from each applicant’s current health insurer, include each insured’s name, and include the date each applicant’s current coverage will end.

Correct Medicare ID Number and Social Security Number – Record the Medicare ID number exactly as it is shown on the applicant’s Medicare ID card; don’t assume these numbers are always the same.

Open enrollment applies only to persons who are first enrolling in Medicare Part B or turning age 65.

Guaranteed Issue applies only to Medicare beneficiaries who are losing (or disenrolling) in their current health care coverage under a qualifying Guaranteed Issue provision and these applications must include proof of credible coverage which supports the qualifying Guaranteed Issue event. (Guaranteed Issue provisions vary by state; if in doubt, call underwriting before taking a Guaranteed Issue application. And, don’t forget to attach the proof of credible coverage to the application.)

Underwritten applies to all other applications, where the applicant must answer all of the health questions.

Proof of credible coverage is required for all Guaranteed Issue applications and must be attached to the application (including an e-App). The document must be from each applicant’s current health insurer, include each insured’s name, and include the date each applicant’s current coverage will end.

Correct Medicare ID Number and Social Security Number – Record the Medicare ID number exactly as it is shown on the applicant’s Medicare ID card; don’t assume these numbers are always the same.