|

If you're not discussing Plan N with your clients, it's time to start. Why? It has very similar coverage to Plan G, which is clearly one of the most popular Med Supp plans out there, next to the Plan F. If your clients are unable to purchase a Plan F due to MACRA, then you may tend to encourage them to purchase a Plan G. And that's always been a smart move. However, the differences between Plan G and Plan N are as follows:

Let's dig a little more into the Plan G vs. Plan N discussion.

If your clients purchase a Plan N:

*Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in admission.

Consider offering Plan N to your clients and carefully explain to them the cost differences, and how in the end, Plan N might be their better option, especially if they don't visit the doctor frequently. In the end, they could wind up saving more money over a Plan G and have the best coverage for their needs.

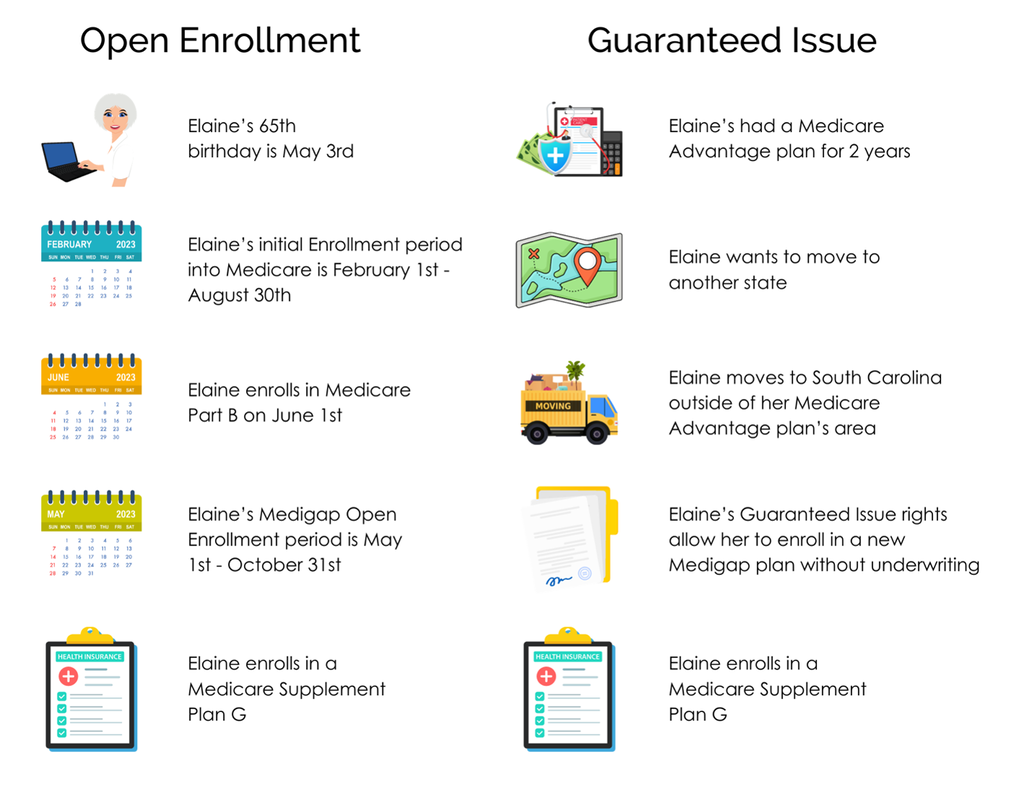

When it comes to Medicare Supplement policies there are times and situations when your client has the right to enroll in a Medigap plan without answering any health questions. The most important of those times being during their six month Medigap Open Enrollment period. This occurs when your client turns 65 or when they first enroll in Medicare Part B.

However, there may be times when you have a client who wants to enroll in a Medicare Supplement and they fall outside of their Open Enrollment period. Perhaps you have a client who's moving and they want to switch plans. Or you might have a client who was enrolled in a Medicare Advantage plan and they want to make the switch to a Medicare Supplement. Regardless of the situation, there may be Guaranteed Issue or Trial right available, allowing them to enroll in a Medigap plan without answering health questions.

Examples of Guaranteed Issue & Trial Rights:

Example: Same Client - Different SituationsYear-round Enrollment & Other Rules

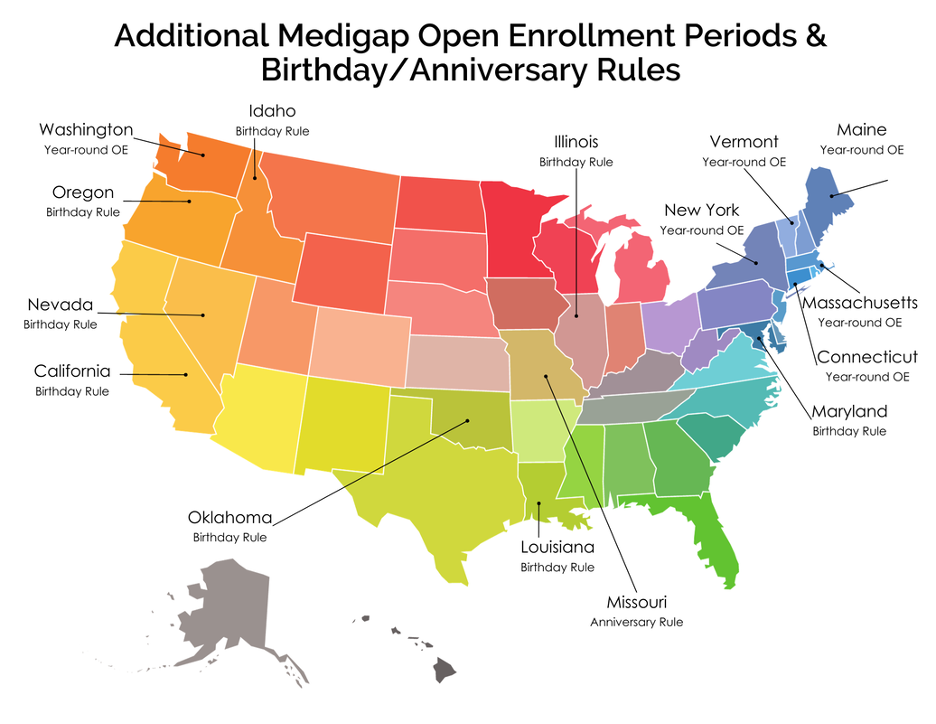

If your client doesn't fall under any of the Guaranteed Issue/Trial Right situations listed above, there are certain states that have year-round open enrollment periods. There are also states that have birthday and anniversary rules which allow your client to switch plans without going through underwriting. Each state has its own regulations and guidelines so it's important to familiarize yourself with them before enrolling your client in a Medicare Supplement plan.

If your client falls outside of their open enrollment period, doesn't live in a state with year-round open enrollment and doesn't qualify for guaranteed issue rights, they will likely have to go through underwriting; and that requires answering medical and pharmaceutical questions on the application as well as during a phone interview.

If you have any questions regarding Guaranteed Issue rights, birthday rules or getting your client through underwriting, please reach out to us and we'll be happy to assist you. Additionally, feel free to download our Medicare Enrollment Periods guide.

|

Archives |